Welcome, travel lovers! As a travel blogger who has explored the world extensively, I’m thrilled to provide this detailed guide on how to choose the airline miles credit card that’s right for you. With the right and best airline miles credit card, you can earn free flights and hotel stays to make your wanderlust dreams come true.

I’ll walk through everything you need to know about how airline miles work, highlight the best airline miles credit cards currently available, and offer tips to maximize your points and miles. Let’s get started on getting you those free flights!

How Do Airline Miles Work?

Before diving into the top mileage credit cards, it’s helpful to understand the basics of how airline rewards programs work.

Airline miles are earned by flying with an airline or using a travel credit card. Most major airlines have their own frequent flyer program that allows you to earn miles that can then be redeemed for free flights and upgrades.

When you fly with an airline, you’ll earn miles based on the distance traveled, your fare class, and your elite status level in their program. With an airline travel credit card, you’ll earn miles through your everyday spending and by hitting initial sign-up bonuses.

Once earned, miles don’t expire as long as you have some type of qualifying activity on your account within an 18-24 month period. This prevents your hard-earned miles from disappearing if you don’t fly frequently.

When it comes to redemptions, airlines use dynamic award pricing, meaning the number of miles needed for an award flight fluctuates based on destination, demand, and other factors. Generally, you’ll get the best value using miles for long-haul international business and first class flights.

To give you an idea, a roundtrip economy ticket within the U.S. can cost between 12,500-30,000 miles while a first class ticket to Asia could run 150,000 miles or more.

Airline miles calculator – When you make a purchase with a credit card that earns airline miles, you’ll accumulate a certain number of miles depending on the purchase amount and card benefits. For example, a $100 purchase may earn you 1,000 miles.

- Miles can then be redeemed for award flights and flight upgrades. Award flight prices are based on mileage amounts—the more miles needed, the more valuable the redemption. Domestic flights usually require 12,500-25,000 miles, while international flights maybe 30,000 miles or more.

- Airline partnerships allow you to pool miles across household members and even transfer miles between frequent flyer programs. This allows you to redeem miles with other airlines if your preferred carrier doesn’t service a desired route.

- Miles don’t expire as long as you have some level of activity in your account every few years. However, award ticket prices and availability can change, so it’s best to redeem miles as far in advance as possible for the best value.

With the basic premise of how miles work clear, let’s explore the best credit cards for maximizing your frequent flyer balances through everyday spending.

Now that you understand the basics of mileage programs, let’s explore some of the best airline credit cards for racking up serious rewards.

Best Airline Miles Credit Cards

With frequent flyer programs no longer serving elite flyers as well as they used to, airline credit cards have become essential for earning a healthy stash of miles.

The key is to focus on cards that offer large sign-up bonuses and strong ongoing point or mile earnings. I’ll share my top picks across the major airlines below.

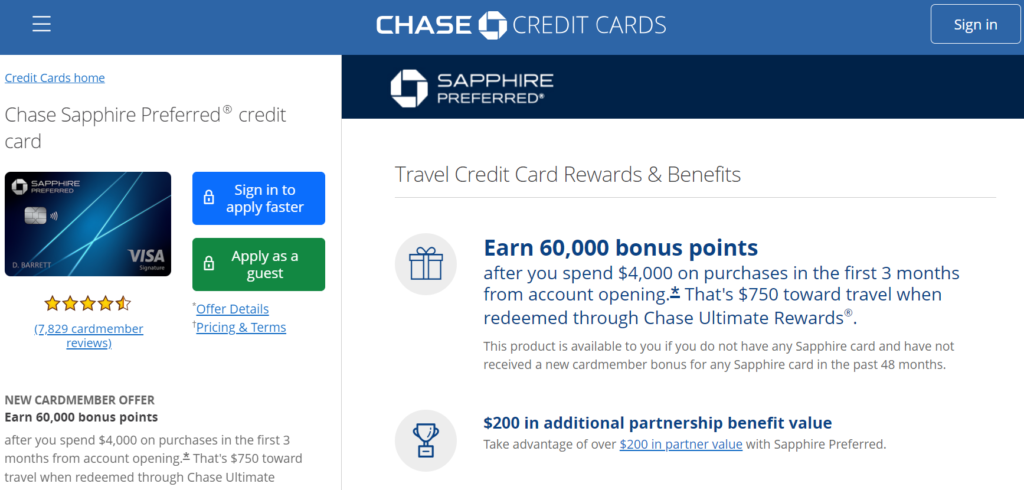

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred is one of the most popular and best airline miles credit card for good reason. New cardholders can earn 60,000 bonus points after spending $4,000 on purchases in the first three months.

Points transfer 1:1 to leading airline and hotel loyalty programs, including United MileagePlus, British Airways Executive Club, and Hyatt Gold Passport. The reasonable $95 annual fee is waived the first year, and you’ll enjoy double points on travel and dining purchases. This is one of the best credit cards for airline miles with no annual fee.

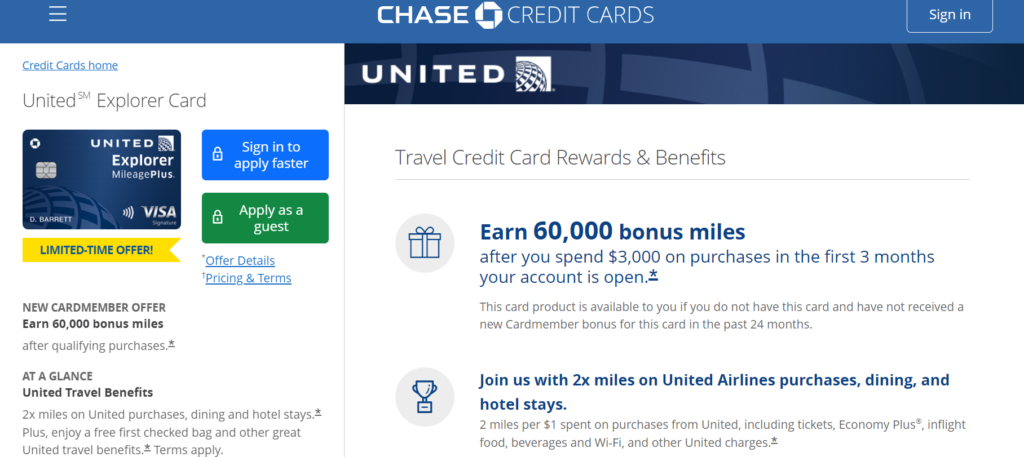

UnitedSM Explorer Card

For United loyalists, the United Explorer card should be the top of the wallet. You’ll earn 40,000 bonus miles after spending $2,000 within the first three months, along with 2x miles per $1 spent on United purchases, dining, and hotel stays.

Cardholders receive their first checked bag free, priority boarding, and two one-time United Club passes each year. There are no foreign transaction fees. The $95 annual fee is waived in the first year.

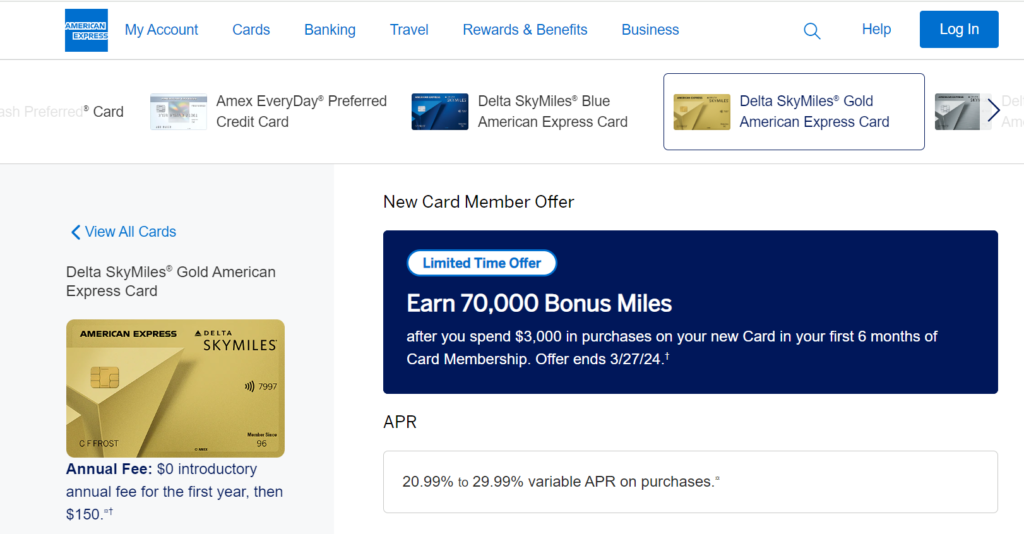

Delta SkyMiles Gold American Express Card

This Delta Amex card makes it easy to rack up SkyMiles quickly. You can earn 40,000 bonus miles after you spend $1,000 in purchases on your new card in your first three months. Plus, take advantage of 2X miles per $1 spent on Delta purchases and at restaurants worldwide.

Card perks include your first checked bag free, main cabin one-priority boarding, and 20% savings on in-flight purchases. The $99 annual fee is waived for the first year.

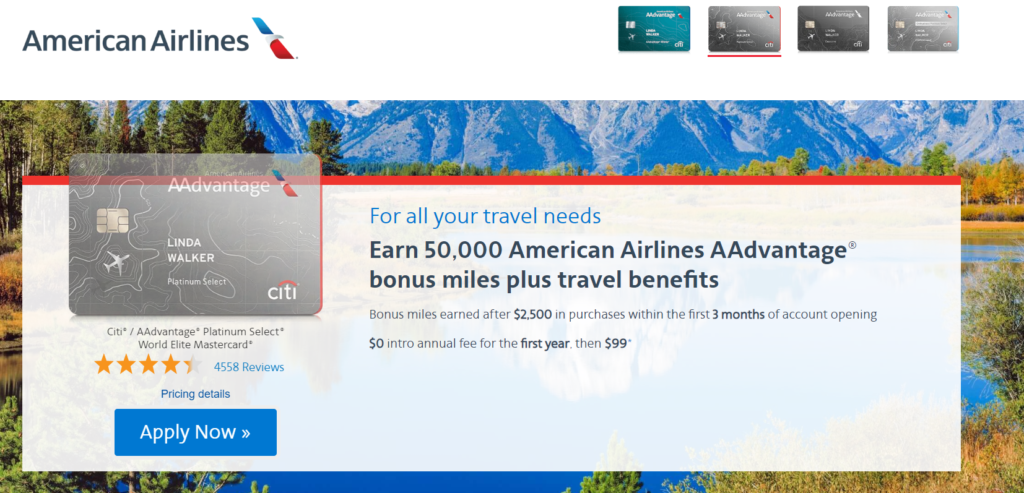

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

For American Airlines devotees, the Citi AAdvantage Platinum Select card is sure to please. New applicants receive 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first three months of account opening.

You’ll enjoy 2X miles on eligible American Airlines purchases and a first checked bag free on domestic American itineraries for you and up to four companions traveling on the same reservation. There are no foreign transaction fees. The $99 annual fee is waived for the first 12 months.

Southwest Rapid Rewards® Premier Credit Card

If Southwest is your airline of choice, the Southwest Rapid Rewards Premier card makes a great option with ample rewards-earning potential. New card members can earn 40,000 points after spending $1,000 on purchases in the first 3 months. You’ll also earn 6,000-anniversary points each card member year.

Everyday spending earns 2x points per $1 spent on Southwest and Rapid Rewards hotel and car rental partner purchases. You’ll enjoy 4 upgraded boardings per year when available and 20% back on in-flight drinks and WiFi. The $99 annual fee doesn’t apply the first year.

This selection provides a nice mix of top airline co-branded credit cards across the major carriers. But what if you aren’t loyal to just one and prefer flexibility? Keep reading!

Best Flexible Travel Rewards Cards

If you fly on a mix of different airlines, flexible travel rewards cards are the way to go. You can transfer points to various airline and hotel partners, choosing whichever makes sense for each trip. Here are my top recommended flexible cards:

Chase Sapphire Reserve®

The premium Chase Sapphire Reserve offers a whopping 50,000-point sign-up bonus when you spend $4,000 in the first 3 months. Chase Ultimate Rewards points transfer 1:1 to airline and hotel partners, and you’ll earn 3x points on travel and dining.

Benefits include a $300 annual travel credit, airport lounge access, and Global Entry or TSA Precheck fee credit. There is a $550 annual fee. This card pairs perfectly with the no annual fee Chase Freedom cards.

Capital One Venture Rewards Credit Card

New Venture cardholders can earn 60,000 bonus miles if you spend $3,000 on purchases in the first 3 months. You’ll earn unlimited 2X miles on every purchase with no category exclusions. Miles transfer to 15+ airline partners or can be redeemed for travel statement credits against past purchases.

The annual fee is $95, waived for the first year. Enjoy up to $100 credit for Global Entry or TSA Precheck and travel accident insurance coverage.

American Express® Gold Card

With the Amex Gold Card, new members can earn 60,000 Membership Rewards® points after spending $4,000 on eligible purchases within the first 6 months. You’ll earn 4x points at restaurants worldwide and at U.S. supermarkets and 3x points on flights booked directly with airlines or on amextravel.com.

Points are valuable when transferred to airline partners for award travel. You’ll also receive up to $120 in annual dining credits. The annual fee is $250.

Citi Premier® Card

I have to mention the Citi Premier Card, which offers an impressive 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening. ThankYou Points can be transferred to 15 airline partners.

You’ll earn 3x points at restaurants, gas stations, air travel, hotels, supermarkets, and select streaming services. There is a $95 annual fee.

This selection of flexible travel cards makes it easy to maximize value across different airline and hotel partners. Pick the one that best matches your spending habits and bonuses.

By pairing one of these flexible point cards with airline co-branded options, you can rapidly accumulate rewards towards free flights and hotel stays. Next, I’ll provide some tips for maximizing miles.

Comparing Airline Miles Credit Cards

Now that we’ve covered the top mileage credit cards, how do you determine which one is right for you? Here are some key factors to consider as you weigh your options:

Annual Spending in Bonus Categories

Analyze a typical year’s spending to see which types of purchases you make the most. Consider cards that match your natural spending – for example, if you dine out frequently, choose a card with strong restaurant rewards.

Value of Sign-Up Bonus

Compare the bonuses and their spending requirements. A card with a high spend threshold but substantial bonus of, say, 75,000 points may be worth more than one offering fewer points for lower spending.

Airline Transfer Partners

Review which carriers are partners for transferring miles. Choose a program with your preferred airline as a partner or one offering flexibility through multiple partners if you switch airlines.

Annual Fee

Consider if a card’s annual fee is offset by its benefits. For example, rebates or travel credits on a card with a $95 fee essentially make it free after accounting for perks. Higher fees demand better benefits.

Travel Goals and Redemptions

Determine when and where you want to travel to gauge which miles will suit your goals. Short domestic trips typically require fewer miles than international awards. Look for transferable currencies.

Credit Score and Spending Power

Know if you qualify for premium cards needing excellent credit. Choose a card that meets minimum spending requirements to earn bonuses without going into debt.

When you’ve evaluated your options through this analytical lens, your best airline miles credit card will become clear. Just be sure to use the card responsibly and pay statements in full each month to avoid interest charges. Now, let’s discuss optimizing your miles through redemption.

Tips for Maximizing Your Miles

Simply opening one of these cards won’t get you far if you don’t use it strategically. Here are my best tips for making the most of your airline miles credit card:

- Hit minimum spend requirements for sign-up bonuses quickly. Consider prepaying bills or taxes if needed.

- Use your card for all daily spending to rack up bonus category points.

- Pay your balance in full each month to avoid negating rewards with interest charges.

- Try to earn status with one airline to enjoy extra perks and bonus-earning potential.

- Transfer points only when you have a redemption in mind to get the best value.

- Compare cash price vs. mileage price to get the best deal when redeeming.

- Be flexible with travel dates and destinations when redeeming miles for award flights. Off-peak dates and less popular routes are cheaper.

- Book award flights using miles at least a few weeks in advance for better availability. Last-minute redemptions will be very expensive.

- Consider redeeming miles for premium cabin international flights to maximize value. 150,000 miles could be worth $5,000+ in first or business class.

- Don’t waste miles on magazine subscriptions or merchandise. Stick to flights, hotels, and transferrable points.

- Research sweet spots and partner transfer bonuses to save miles on quality redemptions.

- Keep your miles active by setting calendar alerts and making small purchases if needed before they expire.

- Monitor your credit card accounts for bonus offers and limited-time transfer bonuses to airline partners.

- Compare the value of different redemption options before transferring or using miles. Do the math.

- Utilize airline shopping portals to earn extra miles for online purchases you’d make anyway.

Following these savvy tips will ensure you squeeze every last ounce of value from your chosen airline miles credit card. Used smartly, they can unlock nearly unlimited free travel!

Frequently Asked Questions

Still, have some questions about choosing the best airline miles credit card? Here are answers to some commonly asked questions:

Which is better, airline miles or flexible travel points?

It depends on your travel habits. If you are loyal to one airline, their co-branded credit card will help you ascend to elite status faster. But flexible points generally offer greater redemption value across multiple partners. Choose based on where you fly most.

What is the best airline miles program overall?

Most rankings consider Alaska Airlines Mileage Plan to be the top U.S. frequent flyer program thanks to reasonable award pricing, valuable partners like Emirates, and regular bonus offers. Southwest Rapid Rewards comes second for its ease of earning and redeeming points.

How much are airline miles worth per point or mile?

It varies greatly, but most valuations estimate airline miles are worth between 1-3 cents per mile on average based on redemption options. Elite status and credit cards help maximize value. Review annual point valuations to choose transfer partners wisely.

Should I pay an annual fee for a premium travel rewards card?

Cards with annual fees above $95 are worth it if you’ll use the perks to offset the cost. For example, the Amex Platinum’s lounge access, airline credits, and hotel elite status are very valuable for frequent travelers. Crunch the numbers based on your habits.

What’s the best airline miles card for someone who doesn’t travel often?

No annual fee cards like the Chase Freedom Unlimited or Wells Fargo Propel offer easy flat-rate point earning that can still transfer to airline partners for occasional travelers. The Wells Fargo card even includes cell phone protection.

I hope this comprehensive guide has given you clarity on choosing the best airline miles credit card tailored to your travel habits and goals. Happy and safe travels! Let me know if you have any other questions.

Also read: HOW TO SAVE BIG BUCKS BOOKING THROUGH COSTCO TRAVEL?